Winston and Rachel Cruze are financial advisors and authors who are known for their work on budgeting, debt repayment, and financial planning.

They have written several books on these topics, including "The Total Money Makeover" and "Smart Money Smart Kids". Winston and Rachel Cruze have also appeared on several television shows and radio programs to discuss their financial advice.

The Cruzes' approach to financial planning is based on the belief that everyone can achieve financial success by following a few simple principles. These principles include creating a budget, living below your means, and investing for the future.

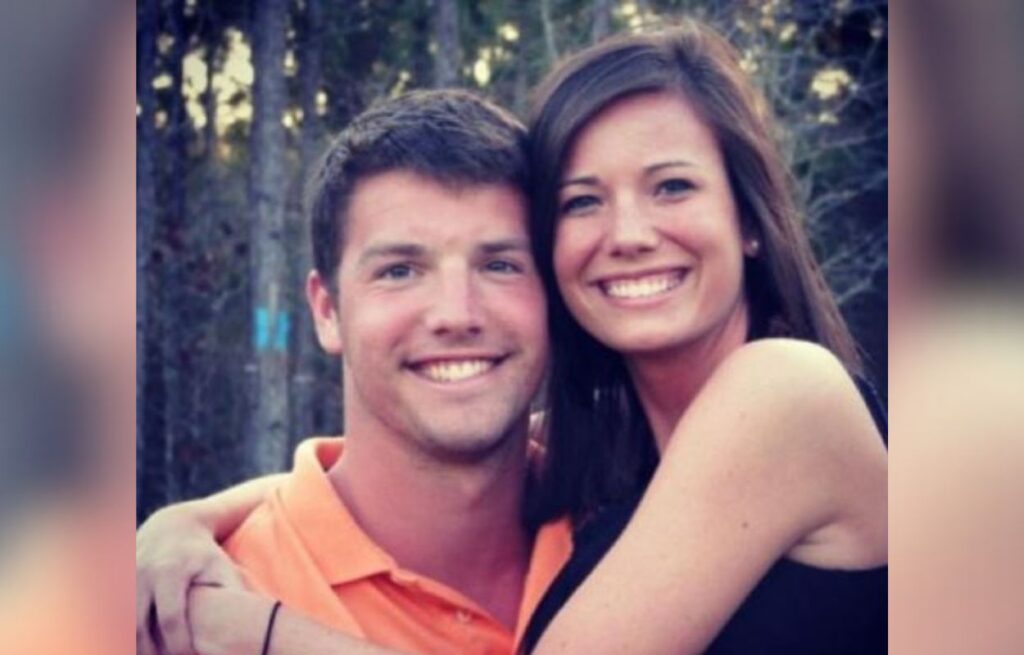

Winston and Rachel Cruze

Having a proper financial plan is one of the keys to living a comfortable and secure life. Winston and Rachel Cruze are financial advisors and authors who have helped millions of people get their finances in order. Their approach to financial planning is based on the belief that everyone can achieve financial success by following a few simple principles.

- Budgeting: Creating a budget is the foundation of any financial plan. It helps you track your income and expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to save more money and reach your financial goals.

- Debt Repayment: If you have debt, it's important to have a plan to pay it off as quickly as possible. Winston and Rachel Cruze recommend using the "debt snowball" method, which involves paying off your smallest debts first and then moving on to your larger debts. This method can help you save money on interest and get out of debt faster.

- Investing: Investing is one of the best ways to grow your wealth over time. Winston and Rachel Cruze recommend starting to invest early and investing regularly. Even small amounts of money can add up over time, especially if you're investing in a diversified portfolio of stocks and bonds.

- Retirement Planning: Retirement may seem like a long way off, but it's never too early to start planning. Winston and Rachel Cruze recommend starting to save for retirement as early as possible and taking advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs.

- Insurance: Insurance is an important part of any financial plan. It can help you protect yourself and your family from financial hardship in the event of an unexpected event, such as a car accident or a medical emergency. Winston and Rachel Cruze recommend having adequate health insurance, life insurance, and disability insurance.

- Estate Planning: Estate planning is the process of planning for the distribution of your assets after you die. It can help you ensure that your wishes are carried out and that your loved ones are taken care of. Winston and Rachel Cruze recommend having a will, a trust, and a power of attorney.

- Education: Financial education is an important part of achieving financial success. Winston and Rachel Cruze recommend learning as much as you can about personal finance so that you can make informed decisions about your money.

- Communication: If you're married or in a relationship, it's important to communicate about your finances. Winston and Rachel Cruze recommend having regular conversations about your financial goals, your budget, and your investments. This can help you avoid financial problems and work together to achieve your financial goals.

Winston and Rachel Cruze have helped millions of people get their finances in order. Their approach to financial planning is simple and effective, and it can help you achieve your financial goals. If you're looking to get started with financial planning, I encourage you to check out their books and resources.

| Name | Occupation |

|---|---|

| Winston Cruze | Financial advisor, author |

| Rachel Cruze | Financial advisor, author |

Budgeting

Winston and Rachel Cruze, renowned financial advisors and authors, emphasize the crucial role of budgeting in achieving financial success. Their approach to budgeting centers around the belief that understanding your cash flow is essential for making informed financial decisions.

- Tracking Income and Expenses: Budgeting involves meticulously recording all sources of income and expenses. By doing so, you gain a clear picture of where your money comes from and where it goes, enabling you to identify areas for potential savings.

- Categorizing Expenses: Once your income and expenses are tracked, categorize them into essential and non-essential expenses. Essential expenses include necessities such as housing, food, and transportation, while non-essential expenses are discretionary items like entertainment and dining out.

- Allocating Funds: Based on your income and expense categorization, you can allocate funds to different categories. This involves prioritizing essential expenses and setting limits for non-essential expenses, ensuring that your spending aligns with your financial goals.

- Regular Review and Adjustment: Budgeting is an ongoing process that requires regular review and adjustment. As your income and expenses change over time, it's important to revisit your budget and make necessary modifications to maintain financial stability.

By following these budgeting principles, as advocated by Winston and Rachel Cruze, individuals can gain control of their finances, reduce unnecessary spending, and work towards achieving their long-term financial objectives.

Debt Repayment

Winston and Rachel Cruze, renowned financial advisors, emphasize the significance of effective debt repayment strategies in achieving financial stability. Their recommended "debt snowball" method has gained widespread recognition for its simplicity and effectiveness.

- Prioritizing Small Debts: The "debt snowball" method focuses on paying off the smallest debts first, regardless of interest rates. This approach provides a sense of accomplishment and motivation, as individuals can quickly eliminate smaller debts and gain momentum in their debt repayment journey.

- Maintaining Focus and Discipline: By tackling smaller debts first, individuals can stay motivated and avoid feeling overwhelmed by larger balances. This disciplined approach helps them maintain focus and adhere to their repayment plan.

- Saving on Interest Charges: While the "debt snowball" method may not always be the most efficient in terms of minimizing interest charges, it can still result in significant savings compared to making only minimum payments on all debts.

- Building Momentum and Confidence: As individuals successfully pay off smaller debts, they gain a sense of accomplishment and confidence in their ability to manage debt. This positive reinforcement can motivate them to stay committed to their repayment plan and achieve their long-term financial goals.

The "debt snowball" method, as advocated by Winston and Rachel Cruze, provides a practical and effective approach to debt repayment. By prioritizing smaller debts, maintaining focus, and building momentum, individuals can overcome debt and improve their financial well-being.

Investing

Investing is a crucial component of Winston and Rachel Cruze's financial philosophy. They believe that investing early and consistently is essential for long-term financial success. Their emphasis on investing stems from the power of compound interest, which allows even small investments to grow significantly over time.

A key principle promoted by Winston and Rachel Cruze is the importance of diversification. They recommend investing in a mix of stocks and bonds to reduce risk and increase the potential for returns. By investing in a variety of assets, investors can spread their risk and improve their chances of achieving their financial goals.

Real-life examples demonstrate the effectiveness of Winston and Rachel Cruze's investing advice. Individuals who have invested early and consistently, even with small amounts of money, have often accumulated substantial wealth over time. The stock market has historically trended upwards, and investing in a diversified portfolio allows investors to benefit from this growth potential.

Understanding the connection between investing and Winston and Rachel Cruze's financial advice is essential for achieving long-term financial success. By following their principles of investing early, investing regularly, and diversifying investments, individuals can build wealth and secure their financial future.

Retirement Planning

Retirement planning is an essential aspect of Winston and Rachel Cruze's financial advice. They emphasize the importance of starting to save for retirement early, even if it's just a small amount, to take advantage of the power of compound interest. They also recommend utilizing tax-advantaged retirement accounts, such as 401(k)s and IRAs, to reduce the tax burden on investment earnings and maximize retirement savings.

- Time Value of Money: The time value of money is a fundamental concept in retirement planning. Money invested today has the potential to grow exponentially over time, thanks to compound interest. Starting to save early allows individuals to harness the power of compounding and maximize their retirement savings.

- Tax Advantages: Tax-advantaged retirement accounts offer significant tax benefits. Contributions to 401(k)s and traditional IRAs are made pre-tax, reducing current income and tax liability. Earnings within these accounts grow tax-deferred, and withdrawals in retirement are taxed at a potentially lower rate.

- Employer Contributions: Many employers offer matching contributions to employee retirement plans, such as 401(k)s. These contributions are essentially free money that can significantly boost retirement savings. Failing to contribute enough to qualify for the full employer match is leaving potential savings on the table.

- Retirement Readiness: Retirement planning helps individuals assess their retirement readiness and make necessary adjustments to their savings and investment strategies. By regularly reviewing their retirement accounts and projections, they can identify any shortfalls or areas for improvement.

Retirement planning is a crucial component of Winston and Rachel Cruze's financial philosophy. By starting early, utilizing tax-advantaged accounts, and considering the time value of money, individuals can increase their chances of achieving a secure and comfortable retirement.

Insurance

Winston and Rachel Cruze, renowned financial advisors and authors, emphasize the significance of insurance as a crucial component of a comprehensive financial plan. Their advice stems from the understanding that life is unpredictable, and unexpected events can have severe financial consequences.

Adequate insurance coverage provides a safety net, protecting individuals and families from the financial burden associated with unforeseen circumstances. Health insurance safeguards against medical expenses, which can be substantial in the event of an illness or injury. Life insurance provides financial support to loved ones in the event of the insured's untimely demise. Disability insurance offers income protection if an individual becomes unable to work due to illness or injury.

Real-life examples underscore the importance of Winston and Rachel Cruze's insurance recommendations. Individuals who have faced medical emergencies or lost income due to disability have expressed gratitude for having adequate insurance coverage. Insurance has enabled them to focus on recovery and well-being without the added stress of financial hardship.

Understanding the connection between insurance and Winston and Rachel Cruze's financial advice is essential for securing financial stability. By incorporating adequate insurance coverage into their plans, individuals can mitigate risks, protect their loved ones, and safeguard their financial future.

Estate Planning

Estate planning is a crucial aspect of Winston and Rachel Cruze's financial advice as it ensures that an individual's wishes regarding the distribution of their assets are honored after their passing. By creating a comprehensive estate plan, individuals can safeguard their loved ones' financial well-being and minimize potential disputes or complications.

- Wills: A will is a legal document that outlines an individual's wishes for the distribution of their assets after they die. It allows individuals to specify who will inherit their property, appoint an executor to manage their estate, and establish guardians for any minor children.

- Trusts: A trust is a legal arrangement that allows an individual to transfer assets to a trustee, who manages and distributes the assets according to the grantor's instructions. Trusts can be used to avoid probate, minimize estate taxes, and provide for specific beneficiaries.

- Power of Attorney: A power of attorney is a legal document that authorizes another individual to make decisions on behalf of the grantor in the event of their incapacity. This is particularly important for individuals who wish to ensure that their financial and medical affairs are handled according to their wishes if they become unable to do so themselves.

Estate planning is an essential component of a sound financial plan. By incorporating these elements into their estate plans, individuals can provide peace of mind for themselves and their loved ones, knowing that their wishes will be respected and their legacy will be preserved.

Education

Understanding the connection between "Education: Financial education is an important part of achieving financial success. Winston and Rachel Cruze recommend learning as much as you can about personal finance so that you can make informed decisions about your money." and "winston and rachel cruze" necessitates an exploration of the various facets of financial education emphasized by the renowned financial advisors and authors.

- Understanding Financial Concepts: Winston and Rachel Cruze emphasize the importance of acquiring a solid understanding of fundamental financial concepts, such as budgeting, investing, and debt management. This knowledge empowers individuals to make informed decisions about their finances and avoid common pitfalls.

- Avoiding Financial Scams: Financial education plays a vital role in protecting individuals from falling prey to fraudulent schemes and scams. By understanding common tactics employed by scammers, individuals can safeguard their hard-earned money and maintain their financial well-being.

- Planning for the Future: Winston and Rachel Cruze stress the significance of financial planning for both short-term and long-term goals. Financial education equips individuals with the skills to informed decisions about saving, investing, and preparing for retirement, ensuring their financial security.

- Making Wise Financial Decisions: Financial education empowers individuals to make wise financial decisions throughout their lives. From choosing the right credit cards to negotiating, understanding financial concepts enables individuals to maximize their financial resources and achieve their financial objectives.

In conclusion, financial education is a cornerstone of Winston and Rachel Cruze's financial philosophy. By promoting financial literacy and empowering individuals with the knowledge to make informed decisions about their money, they help individuals achieve financial success and secure their financial futures.

Communication

Effective financial communication is a cornerstone of Winston and Rachel Cruze's approach to financial success, particularly within the context of marriage or relationships. Their emphasis on open and regular discussions about financial matters stems from the understanding that aligned financial goals and strategies are crucial for couples to achieve their financial objectives.

Financial communication fosters transparency and trust between partners, allowing them to make informed decisions together. By sharing financial goals, couples can ensure that their spending, saving, and investment strategies are in sync, avoiding potential conflicts or misunderstandings.

Real-life examples abound, demonstrating the positive impact of financial communication in relationships. Couples who prioritize open discussions about money report higher levels of financial satisfaction, reduced stress, and a stronger sense of teamwork towards achieving their financial dreams.

In summary, the connection between "Communication: If you're married or in a relationship, it's important to communicate about your finances. Winston and Rachel Cruze recommend having regular conversations about your financial goals, your budget, and your investments. This can help you avoid financial problems and work together to achieve your financial goals." and "winston and rachel cruze" highlights the importance of financial communication as an integral component of their financial philosophy. By fostering open and honest communication about finances, couples can align their goals, make informed decisions, and increase their chances of achieving financial success together.

Frequently Asked Questions about Winston and Rachel Cruze

Winston and Rachel Cruze are renowned financial advisors and authors who have helped millions of people achieve financial success. This FAQ section addresses some of the most common questions and misconceptions about their approach to personal finance.

Question 1: Is Winston and Rachel Cruze's approach to budgeting too restrictive?

Answer: Winston and Rachel Cruze's budgeting method is designed to be flexible and adaptable to individual needs and circumstances. While they emphasize the importance of tracking expenses and living below one's means, they also encourage individuals to find a budgeting system that works for them and allows them to achieve their financial goals.

Question 2: Is it necessary to pay off all debt before investing?

Answer: While Winston and Rachel Cruze generally recommend paying off high-interest debt before investing, they recognize that there may be exceptions to this rule. Individuals with a stable income and a low debt-to-income ratio may consider investing a portion of their income while still making regular debt payments.

Question 3: Is it too late to start saving for retirement?

Answer: It is never too late to start saving for retirement. Winston and Rachel Cruze emphasize the importance of starting early, even with small contributions. Taking advantage of tax-advantaged retirement accounts and utilizing compound interest can help individuals build a substantial retirement nest egg over time.

Question 4: Is life insurance really necessary?

Answer: Life insurance can provide valuable financial protection for loved ones in the event of an untimely death. Winston and Rachel Cruze recommend that individuals consider their family's financial needs and income-earning potential when determining the appropriate amount of life insurance coverage.

Question 5: Is it possible to achieve financial success without a high income?

Answer: Financial success is not solely dependent on income level. Winston and Rachel Cruze emphasize the importance of responsible money management, including budgeting, avoiding unnecessary debt, and investing wisely. Individuals with modest incomes can achieve financial success by living within their means and making smart financial choices.

Question 6: How do I find a financial advisor?

Answer: Finding a qualified financial advisor is crucial for personalized financial guidance. Winston and Rachel Cruze recommend seeking referrals from trusted sources, interviewing potential advisors, and choosing someone who aligns with your financial values and goals.

Summary of key takeaways or final thought: Winston and Rachel Cruze's financial advice is grounded in the principles of responsible money management, long-term planning, and a commitment to financial education. Their approach empowers individuals to take control of their finances, achieve their financial goals, and secure their financial future.

Transition to the next article section: For more in-depth information on Winston and Rachel Cruze's financial philosophy, explore the following resources:

Winston and Rachel Cruze's Financial Tips

Winston and Rachel Cruze, renowned financial advisors and authors, have dedicated their careers to helping individuals achieve financial success. Their practical and straightforward advice has empowered millions of people to take control of their finances and secure their financial futures.

Tip 1: Create a Comprehensive Budget: A budget is the foundation of any sound financial plan. Track your income and expenses meticulously to identify areas for potential savings and ensure that your spending aligns with your financial goals.

Tip 2: Prioritize Debt Repayment: High-interest debt can be a significant financial burden. Implement a debt repayment strategy, such as the "debt snowball" method, to eliminate debt faster and save money on interest charges.

Tip 3: Invest for the Long Term: Investing is essential for building wealth and achieving financial independence. Start investing early, even with small amounts, and take advantage of the power of compound interest to grow your investments over time.

Tip 4: Plan for Retirement: Retirement may seem distant, but it's never too early to start planning. Contribute regularly to tax-advantaged retirement accounts, such as 401(k)s and IRAs, to secure your financial future.

Tip 5: Protect Your Assets: Insurance plays a crucial role in financial planning. Obtain adequate health insurance, life insurance, and disability insurance to protect yourself and your loved ones from unforeseen events.

Tip 6: Seek Professional Advice: If you need personalized financial guidance, consider consulting a qualified financial advisor. A reputable advisor can help you develop a customized financial plan that aligns with your unique needs and goals.

Tip 7: Educate Yourself: Financial literacy is essential for making informed financial decisions. Stay up-to-date on personal finance topics by reading books, attending workshops, or utilizing online resources.

Tip 8: Stay Committed: Achieving financial success requires discipline and consistency. Stay committed to your financial goals, track your progress regularly, and make adjustments as needed to ensure you remain on the path to financial well-being.

Summary of key takeaways or benefits: Winston and Rachel Cruze's financial tips empower individuals to take control of their finances, make informed decisions, and secure their financial futures. By implementing these tips, you can achieve your financial goals, live a more secure life, and build a solid financial foundation for yourself and your loved ones.

Transition to the article's conclusion: Explore the following resources for more in-depth information on Winston and Rachel Cruze's financial advice and strategies.

Winston and Rachel Cruze

Throughout this article, we have explored the multifaceted financial advice and strategies advocated by Winston and Rachel Cruze. Their emphasis on budgeting, debt repayment, investing, retirement planning, insurance, and financial education has transformed the financial lives of countless individuals.

By adhering to their principles of responsible money management, long-term planning, and a commitment to financial literacy, you can empower yourself to take control of your finances, achieve your financial goals, and secure your financial future. Remember, financial success is not a destination but a journey that requires discipline, consistency, and a commitment to making informed financial decisions.

Unveiling The Inspiring Journey Of Michael Jackson's Mother: Uncovering Her Age And Legacy

Unveiling Corey Feldman's Net Worth 2024: Secrets And Surprises Revealed

Unlock The Secrets: Rachel Cruze's Age Unveiled

Rachel Cruze Net Worth Age, Height, Weight, Husband, Kids

Winston Cruze (Rachel Cruze's Husband) Wiki, Bio, Net Worth, Kids, Age

ncG1vNJzZmilkaKvsLrGZ6psZqWoerix0q1ka2aRoq67u82arqxmk6S6cMPIp6qtp55irq%2BwjKuYnKCVoXqkvtSznGegpKK5