Eduardo Santamarina Net Worth refers to the total value of the financial assets and liabilities owned by the Mexican actor Eduardo Santamarina. It encompasses his earnings from acting, endorsements, investments, and other sources minus any debts or obligations.

Determining an individual's net worth provides insights into their financial success, investment acumen, and overall economic well-being. It can also serve as an indicator of their lifestyle, spending habits, and charitable contributions.

In the case of Eduardo Santamarina, his net worth has been shaped by his extensive career in the entertainment industry, spanning several decades. His notable performances in telenovelas and films have garnered him widespread recognition and commercial success.

Eduardo Santamarina Net Worth

Eduardo Santamarina's net worth encompasses various aspects that contribute to his overall financial standing. These key aspects include:

- Income: Earnings from acting, endorsements, and investments

- Assets: Real estate, vehicles, and other valuable possessions

- Investments: Stocks, bonds, and other financial instruments

- Debt: Mortgages, loans, and other financial obligations

- Taxes: Income tax, property tax, and other government levies

- Lifestyle: Expenses related to housing, transportation, and personal needs

- Charitable Contributions: Donations to charitable causes and organizations

- Estate Planning: Arrangements for the distribution of assets after death

These aspects are interconnected and influence Eduardo Santamarina's net worth. His income and assets contribute positively, while debt and taxes reduce it. Lifestyle expenses and charitable contributions impact his cash flow and overall financial picture. Estate planning ensures the preservation and distribution of his wealth according to his wishes.

Understanding these key aspects provides a comprehensive view of Eduardo Santamarina's financial well-being and the factors that shape it.

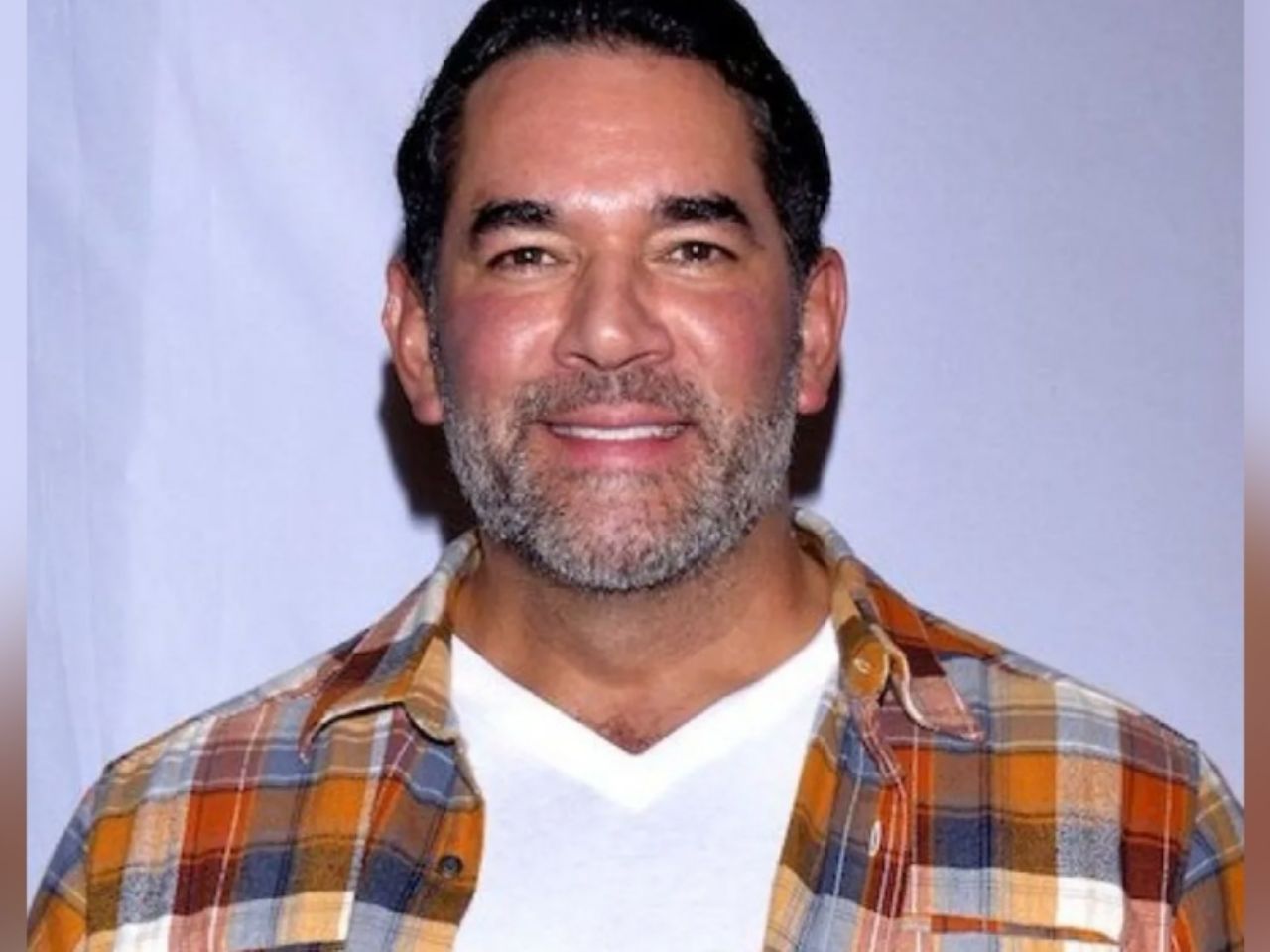

| Name | Eduardo Santamarina |

|---|---|

| Birth Date | July 9, 1968 |

| Birth Place | Veracruz, Mexico |

| Occupation | Actor |

| Years Active | 1992-Present |

| Net Worth | $10 million (estimated) |

Income

Income plays a crucial role in shaping Eduardo Santamarina's net worth. His earnings from acting, endorsements, and investments are the primary sources that contribute to his overall financial standing.

- Acting: As a successful actor, Santamarina commands significant fees for his roles in telenovelas and films. His extensive filmography and lead roles have consistently generated a substantial portion of his income.

- Endorsements: Santamarina's popularity and image have made him a sought-after endorser for various brands and products. Partnerships with companies in industries such as fashion, beauty, and lifestyle contribute to his income stream.

- Investments: Beyond entertainment, Santamarina has also ventured into investments to diversify his income sources. Investments in real estate, stocks, and other financial instruments can provide passive income and long-term growth potential.

The combination of these income streams has significantly impacted Eduardo Santamarina's net worth. His ability to generate consistent income from multiple sources has allowed him to accumulate wealth, invest in his future, and maintain a comfortable lifestyle.

Assets

Assets, including real estate, vehicles, and other valuable possessions, play a significant role in Eduardo Santamarina's net worth. These assets represent a store of value and contribute to his overall financial well-being.

Real estate, particularly properties in prime locations, often appreciates in value over time. Santamarina's investments in real estate provide him with a stable asset that can generate rental income, capital gains, and potential tax benefits. Vehicles, while subject to depreciation, can also hold value and provide reliable transportation. Other valuable possessions, such as artwork, jewelry, or collectibles, can further enhance his net worth.

The value of these assets contributes to Santamarina's financial security and liquidity. In times of economic uncertainty or financial need, he can leverage these assets to secure loans, generate income, or meet expenses. Additionally, owning valuable assets can provide psychological comfort and a sense of financial stability.

Investments

Investments in stocks, bonds, and other financial instruments form a crucial component of Eduardo Santamarina's net worth and contribute to his long-term financial security.

- Stocks: Stocks represent ownership shares in publicly traded companies. When the companies perform well and their stock prices rise, Santamarina's investment value increases. Dividends, or regular payments from the companies, provide additional income.

- Bonds: Bonds are fixed-income securities that provide regular interest payments. They offer a lower risk compared to stocks but typically yield lower returns. Santamarina can diversify his portfolio by investing in a mix of corporate and government bonds.

- Mutual Funds and Exchange-Traded Funds (ETFs): These investment vehicles pool money from multiple investors and invest it in a diversified portfolio of stocks, bonds, or other assets. They offer instant diversification and professional management, reducing risk and potentially enhancing returns.

- Alternative Investments: Beyond traditional stocks and bonds, Santamarina may explore alternative investments such as real estate investment trusts (REITs), private equity, or venture capital. These investments can provide diversification, potential for higher returns, but also carry higher risks.

By investing in a diversified portfolio of financial instruments, Eduardo Santamarina mitigates risk, seeks growth, and generates passive income. These investments contribute significantly to his overall net worth and provide a solid financial foundation for his future.

Debt

Understanding the connection between debt and Eduardo Santamarina's net worth is crucial for assessing his overall financial health and stability. Debt represents borrowed funds that must be repaid with interest, potentially affecting his cash flow and long-term financial goals.

- Mortgages: A mortgage is a type of loan secured by real estate, typically a primary residence or investment property. Repaying a mortgage involves regular payments of principal and interest, which can be a significant expense.

- Loans: Loans can come in various forms, such as personal loans, business loans, or auto loans. These loans can be used for various purposes, from consolidating debt to financing major purchases. Interest rates and repayment terms vary depending on the type of loan and the lender.

- Other financial obligations: Beyond mortgages and loans, other financial obligations may include credit card debt, unpaid taxes, or contractual commitments. These obligations can accumulate interest and penalties if not managed effectively.

High levels of debt can strain Santamarina's cash flow, limit his investment options, and hinder his ability to build wealth. Conversely, managing debt responsibly can help him maintain a positive credit score, qualify for lower interest rates, and free up more capital for investments and other financial goals.

Taxes

Taxes are mandatory payments levied by government entities on individuals and businesses to finance public services and infrastructure. Eduardo Santamarina, like all taxpayers, is subject to various taxes that impact his net worth.

Income tax is a significant factor influencing Santamarina's net worth. As an actor and entrepreneur, his income from various sources is subject to taxation. Higher income tax rates can reduce his disposable income, affecting his ability to save, invest, and grow his wealth.

Property tax is another tax that affects Santamarina's net worth. As a property owner, he is required to pay taxes based on the assessed value of his real estate holdings. Property taxes can be substantial, especially for high-value properties, and can impact his cash flow and overall financial planning.

Understanding the impact of taxes on his net worth is crucial for Santamarina's financial management. Effective tax planning strategies, such as utilizing tax deductions and optimizing investments, can help him minimize his tax liability and preserve more of his wealth.

Lifestyle

Lifestyle expenses play a significant role in shaping Eduardo Santamarina's net worth. The choices he makes regarding housing, transportation, and personal needs directly impact his financial well-being.

Housing expenses, typically the largest component of lifestyle expenses, can vary greatly depending on factors such as location, property type, and amenities. Santamarina's decision to own a luxurious residence in a prime neighborhood can significantly increase his housing costs compared to renting a more modest property. Similarly, his choice of vehicle, whether a fuel-efficient car or a high-end sports car, impacts his transportation expenses.

Personal needs, encompassing everything from dining out to entertainment and travel, also contribute to Santamarina's lifestyle expenses. While these expenses may provide enjoyment and comfort, they can accumulate over time and affect his overall financial picture.

Understanding the connection between lifestyle and net worth is crucial for Santamarina to make informed financial decisions. By carefully considering his expenses and aligning them with his financial goals, he can optimize his net worth and secure his financial future.

Charitable Contributions

Charitable contributions, referring to Eduardo Santamarina's donations to charitable causes and organizations, hold significance as a component of his net worth. They reflect his values, philanthropic endeavors, and commitment to social responsibility.

Santamarina's charitable contributions can impact his net worth both directly and indirectly. Direct impact includes the reduction of taxable income, as donations to qualified charities are tax-deductible. This can result in tax savings, potentially increasing his disposable income and overall net worth.

Indirectly, charitable contributions can enhance Santamarina's reputation and public image, which may positively influence his earning potential through endorsements, sponsorships, or other business opportunities. Additionally, supporting charitable causes aligned with his values can provide personal fulfillment and a sense of purpose, contributing to his overall well-being.

Understanding the connection between charitable contributions and net worth is crucial for informed financial planning and decision-making. By considering the tax benefits, reputational impact, and personal values associated with charitable giving, individuals can optimize their financial strategies while making a positive contribution to society.

Estate Planning

Estate planning plays a crucial role in managing and preserving Eduardo Santamarina's net worth. It encompasses legal and financial strategies designed to ensure an orderly distribution of his assets after his passing, in accordance with his wishes and objectives.

- Wills: A will is a fundamental estate planning tool that outlines how an individual's assets will be distributed upon their death. It allows Santamarina to specify his beneficiaries, appoint an executor to administer the estate, and establish guardianship for any minor children.

- Trusts: Trusts are legal entities that hold and manage assets for the benefit of designated beneficiaries. Santamarina may establish trusts to reduce estate taxes, protect assets from creditors, or provide ongoing support for loved ones.

- Power of Attorney: A power of attorney grants legal authority to a trusted individual to make financial and legal decisions on Santamarina's behalf in the event of his incapacity or death.

- Beneficiary Designations: Santamarina can designate beneficiaries for specific assets, such as retirement accounts or life insurance policies. These designations override any instructions in his will and ensure that these assets are distributed according to his wishes.

Effective estate planning provides Santamarina with peace of mind, knowing that his assets will be managed and distributed according to his intentions. It helps minimize estate taxes, avoid probate court, and ensure a smooth transition of wealth to his beneficiaries. Ultimately, estate planning contributes to the preservation and continuity of Santamarina's net worth beyond his lifetime.

Frequently Asked Questions about Eduardo Santamarina's Net Worth

This section addresses common questions and misconceptions surrounding Eduardo Santamarina's net worth, providing concise and informative answers to enhance understanding.

Question 1: How has Eduardo Santamarina accumulated his wealth?

Eduardo Santamarina's wealth primarily stems from his successful career in the entertainment industry. His earnings from acting, endorsements, and investments have significantly contributed to his net worth.

Question 2: What is the estimated value of Eduardo Santamarina's net worth?

As of 2023, Eduardo Santamarina's net worth is estimated to be around $10 million. However, it's important to note that net worth can fluctuate over time due to various factors.

Question 3: How does Eduardo Santamarina manage and invest his wealth?

Santamarina's wealth management strategies involve a diversified portfolio of assets, including real estate, stocks, bonds, and alternative investments. He also utilizes trusts and estate planning to preserve and distribute his wealth effectively.

Question 4: What impact does Eduardo Santamarina's lifestyle have on his net worth?

Santamarina's lifestyle choices, such as his residence, transportation, and personal expenses, can influence his net worth. Balancing his spending habits with his income and investment returns is crucial for maintaining his financial well-being.

Question 5: How does Eduardo Santamarina contribute to charitable causes?

Santamarina actively supports charitable organizations and causes. His charitable contributions not only impact his net worth but also reflect his philanthropic values and commitment to social responsibility.

Question 6: What are the key factors that contribute to Eduardo Santamarina's net worth?

Santamarina's net worth is influenced by multiple factors, including his income streams, asset portfolio, debt obligations, lifestyle expenses, charitable contributions, and estate planning strategies.

Summary: Understanding Eduardo Santamarina's net worth involves examining his income sources, asset allocation, debt management, lifestyle choices, philanthropic endeavors, and estate planning. These factors collectively shape his financial standing and provide insights into his overall wealth management approach.

Transition: Explore the following section to delve deeper into the intricacies of Eduardo Santamarina's net worth and the strategies he employs to maintain his financial well-being.

Tips for Understanding and Managing Net Worth

Understanding and effectively managing your net worth is crucial for long-term financial well-being. Here are some valuable tips to guide you in this process:

Tip 1: Track Your Income and Expenses: Keep a detailed record of all your income sources and expenses. This provides a clear picture of your cash flow and helps identify areas for optimization.

Tip 2: Create a Budget: Develop a realistic budget that aligns with your financial goals. Allocate funds to essential expenses, savings, and investments.

Tip 3: Diversify Your Investments: Spread your investments across various asset classes, such as stocks, bonds, and real estate, to reduce risk and enhance returns.

Tip 4: Manage Debt Wisely: Minimize unnecessary debt and prioritize paying off high-interest debts. Consider consolidating debt to secure lower interest rates.

Tip 5: Plan for Retirement: Start saving for retirement as early as possible. Utilize tax-advantaged accounts like 401(k)s or IRAs to maximize your savings.

Tip 6: Seek Professional Advice: Consult with a financial advisor if needed. They can provide personalized guidance, investment recommendations, and estate planning strategies.

Summary: Understanding and managing your net worth requires discipline, knowledge, and strategic planning. By implementing these tips, you can make informed financial decisions, grow your wealth, and secure your financial future.

Transition: By understanding and effectively managing your net worth, you gain greater control over your financial well-being, set yourself up for success, and achieve your long-term financial goals.

Eduardo Santamarina Net Worth

In conclusion, Eduardo Santamarina's net worth stands as a testament to his dedication, entrepreneurial spirit, and prudent financial management. His diverse sources of income, strategic investments, and commitment to philanthropy paint a picture of a financially savvy individual who has achieved remarkable success.

Understanding the nuances of net worth empowers us to make informed financial decisions, optimize our investments, and plan for a secure future. By examining Eduardo Santamarina's net worth and the strategies he employs, we gain valuable insights that can guide our own financial journeys.

Unveiling The Secrets: Jann Mardenborough's Height And Its Impact

Eduardo Santamarina: Uncovering The Essence Of Mexican Stardom

Unveiling Chef Brooke's Marital Bliss: A Culinary Journey Of Love

ncG1vNJzZmifkZi8s76NmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLHDrpirnJ9iwKK605qkmqqZo65uusStZLCnoqm1b7TTpqM%3D